2023 News and Information

Rachel Brummet Promoted to Branch Manager

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, has announced Rachel Brummett has been promoted to Branch Manager at the Clarks Summit Office.

In making the announcement Sheridan stated, “Rachel has displayed commitment to our customers and internal partners.” He continued, “We are delighted to have her expand her role and showcase our core values as she continues to manage the relationships held in our Clarks Summit community.”

As Branch Manager, Brummett will be responsible for opening accounts, oversight of office operations, customer retention, and so much more.

She is a graduate of Garfield High School as she was born in California, moved to New Jersey in 1996, and later moved to Pennsylvania in 2013 where she has since resided.

Brummett started her career in the financial industry 20 years ago, most recently being an assistant branch manager at another local financial institution. She joined HNB in May of 2022 as Teller/CSR at our Montdale Office. She was later promoted to Branch Supervisor of our Clarks Summit in June of 2023, and now promoted to Branch Manager of the HNB Clarks Summit Office.

In commenting on her new role at the bank, Brummett noted, “Working here at HNB has made me feel fulfilled. It feels like I have come full circle. HNB has treated me like family, and I really appreciate that.”

Outside of the bank, she enjoys watching her favorite sports teams such as the New York Giants, New York Rangers and the New York Mets. She also likes the outdoors, road trips, concerts, and spending time with her family.

Cassandra Saul Promoted to Branch Manager

Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, has announced Cassandra Saul has been promoted to Branch Manager at the Lakewood Office.

In making the announcement Sheridan stated, “Cassie has shown incredible dedication to our customers and local communities.” He continued, “We are glad to have her take on this role to express her local knowledge and understanding of our core values as she continues to expand her career at HNB.”

As Branch Manager, Saul will be responsible for managing the daily operations of the HNB Lakewood Office to ensure customer expectations are met. She will lead frontline personnel, while ensuring the office is compliant with audits and account management.

She is a graduate of Forest City Regional School District and resides in Pleasant Mount, PA.

Saul started her career in the banking industry in 2017 with HNB as Part-Time Teller, promoted to Teller/CSR, Head-Teller/CSR, Assistant Branch Manager of Forest City and Lakewood Offices, Branch Supervisor, and now, Branch Manager at the Lakewood Office.

In commenting on her new role at the bank, Saul noted, “In six short years, working at HNB has given me the opportunity to grow in the banking industry. Starting out as a Part-Time Teller and working my way to Branch Manager shows how the bank has many opportunities available. Hard work, dedication to be more knowledgeable, and support from my co-workers leads to never ending success at HNB.”

Outside of the bank, she enjoys golfing, hunting and being on the farm or at our retail meat store, Komar Farm and Meats, in Pleasant Mount, PA.

Sharon Smith Promoted to Branch Manager

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, announced Sharon Smith has been promoted to Branch Manager at the Lackawaxen Office.

In making the statement, Sheridan noted, “We are pleased extend this opportunity to Sharon as she grows her career at HNB.” He continued, “She has been proactive in our Lackawaxen community and eager to assist customers with their banking needs which is vital to the HNB & me experience.”

Originally from Queens, NY, Smith moved to the area in her teenage years, graduating from Honesdale High School, and has since received her Bachelor of Science Degree in Management from East Stroudsburg University. She has then pursued over 20 years in retail management at the Dollar Tree in Honesdale and has now spent 2 years in the financial industry.

As Branch Manager, Smith is responsible for serving the Lackawaxen community by upholding HNB's strong values and superior service. On top of managing the operations of the office, she will assist customers as they visit for their personal and business banking needs.

In mentioning her new role with HNB, Smith said, “I am glad to be a part of an organization that encourages professional growth and values support for our customers, employees, and communities.” She continued, “I am happiest when I am assisting customers with their banking needs and building relationships within this community and beyond.”

Since 2022, she has been a volunteer on the Board of Directors for Victims' Intervention Program of Wayne and Pike Counties. She is also a volunteer/member for the Honesdale High School Band Parents Organization.

Outside of the bank, she enjoys spending time with her family.

Commencement of the Stegner Foundation

(Honesdale, PA) – Today, 12 organizations in Wayne County and one in Rochester, NY, celebrated the receipt of a financial gift they will now receive in perpetuity all thanks to a long-established Honesdale family. The Robert E. and Leila Stegner Family Foundation was created by siblings Dr. Robert, Joan and Janet Stegner, and established once the last surviving of the three, Joan, passed away on October 7th, 2022. HNB has served as a trustee for the Foundation since May of 2011.

(Honesdale, PA) – Today, 12 organizations in Wayne County and one in Rochester, NY, celebrated the receipt of a financial gift they will now receive in perpetuity all thanks to a long-established Honesdale family. The Robert E. and Leila Stegner Family Foundation was created by siblings Dr. Robert, Joan and Janet Stegner, and established once the last surviving of the three, Joan, passed away on October 7th, 2022. HNB has served as a trustee for the Foundation since May of 2011.

Their parents, Robert and Leila Stegner, owned and operated the J.H. Stegner Grocery Store and Bakery. Their son, Dr. Robert, tended to the community’s dental needs. Their twin daughters, Joan and Janet, taught many young students how to play piano in the family’s living room.

The Stegner Siblings selected 13 organizations to receive annual donations from the Robert E. and Leila Stegner Family Foundation, including: Bethany Cemetery, Honesdale Fire Department Hose Company No. 1, Alert Hook & Ladder Co. No. 2, Protection Engine No. 3, and Texas No. 4, Victims Intervention Program, Wayne County Food Pantry, Wayne County Children and Youth, American Red Cross NEPA Chapter, Salvation Army, the Eastman School of Music at the University of Rochester, Honesdale Ministerium, and the Wayne Memorial Health Foundation.

The commencement ceremony was held on Tuesday, December 5th, at 6th and River in Honesdale, to award recipients their contributions and learn about the legacy that the Stegner family left in the local area.

Charlie Curtin, VP, Trust Officer at HNB, and Administrator of the Stegner Foundation mentioned, “Let us today give thanks to the Stegner family and going forward continue to do good works with this most generous gift."

Representatives from 11 of the 13 organizations were able to attend and celebrate the heritage left to support the members across our community.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna, and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

Photo Caption: Front Row (Left to Right): Rick Dulay, Jerry Theobald, Lisa Champeau, Jim Pettinato, David Mazzenga, Peter Mikulak, Kipp Welsh, Derek Williams. Second Row (Left to Right): Barry Zeglen, Brenda Zeglen, Pamela Wilson, Michelle Valinski, Nancy Propst, Lyn Hoffman, Roberta Conroy, Heidi D’Aleo, Sandra Nunn, Linda Rutherford, Charles Curtin, Ryanne Jennings, Connor Simon, Robert Kretschmer, Zoe Silvestri, Rev. John Banks. Back Row (Left to Right): Patricia Dunsinger, Linda Campbell, Terry Campbell, David Hartung, Clarissa Wimmers, Linda Zimmer, Rev. Eric Funk, Randi Bannon, Amy Hiller, Rev. Jay O’Rear.

Ryan Ehrhardt Promoted to Commercial Loan Officer I

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, has announced Ryan Ehrhardt has been promoted to Commercial Loan Officer I.

In making the announcement, Sheridan stated, “We are pleased to have Ryan expand his profession here at HNB.” He continued, “He has shown incredible commitment to supporting our community partners by incorporating his professional demeanor and local expertise.”

As Commercial Loan Officer I, Ehrhardt will be responsible for developing and maintaining commercial loan relationships and negotiating terms for small businesses and other commercial loan applicants.

Ehrhardt began his career in the financial industry in 2019 with a Commercial Lending Internship at HNB. After graduating college, he managed Client Services at Vanguard before returning to HNB as Credit Analyst in 2021 and soon after Commercial Loan Portfolio Manager. He will continue his career as Commercial Loan Officer I.

In commenting on his new role at HNB, Ehrhardt noted, “Working at HNB has allowed me to grow both personally and professionally. I'm grateful to be a part of the HNB family and I am excited for the continued opportunity to work closely with local businesses and members of the communities we proudly serve.”

Ehrhardt is from Paupack, Pennsylvania and graduated from Wallenpaupack Area High School. He is a graduate of Bloomsburg University, 2020 (Magna Cum Laude) and has obtained a Bachelor of Science and Business Administration (BSBA) in Marketing and Finance.

Outside of the bank, he enjoys spending time with his dog Levi, skiing, boating, fishing, hunting, and hiking.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

Sarah O'Hora Promoted to Commercial Loan Officer II

Honesdale, PA – Thomas E. Sheridan Jr., President and CEO of The Honesdale National Bank, announced Sarah O’Hora has been promoted to Commercial Loan Officer II.

In making the statement, Sheridan noted, “Sarah has shown commitment to both our customers and entire community throughout her longstanding career at HNB.” He continued, “Her promotion is a result of her dedication and contributions to the strength of our Commercial Lending Team.”

O’Hora is a graduate of Greencastle-Antrim High School and received a Bachelor of Science Degree (Cum Laude) from Millersville University in 2011. She also attended the PA Bankers School of Banking in 2015, Leadership Northern Poconos Class of 2016, ABA Bank Marketing School Program in 2016, and PA Bankers School of Commercial Lending in 2023.

Currently residing in Lake Ariel, PA, she started her 12-year career in the financial industry with HNB. Previous positions included Teller, Customer Service Representative, Marketing Assistant, Marketing and Communications Specialist, Commercial Loan Portfolio Manager, Commercial Loan Officer I, and she will continue her career as Commercial Loan Officer II.

In this role, she is responsible for developing and managing commercial loan relationships, collecting and analyzing financial information, and negotiating terms for small business and other commercial loan applicants.

In mentioning her time with HNB, O’Hora said, “My work at HNB has always allowed me to support those in my local community.” She continued, “As a commercial lender, I get to help local business owners reach goals, expand their growing businesses, and much more. I believe these business owners are the foundation on which our communities are built.”

In her spare time, she is a Worship Director, Leader, and Partner at Wallenpaupack Church. She enjoys spending time with her family, golfing, pheasant hunting, target shooting, side-by side rides, and walks in the woods with their family dog, Nelli.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

Marlie Martines Joins HNB as a Compliance Officer

Honesdale, PA – Thomas E. Sheridan, President, & CEO of The Honesdale National Bank, announced Marlie Martines has joined HNB as a Compliance Officer.

President & CEO, Thomas E. Sheridan Jr., noted, “We are looking forward to having Marlie as part of the HNB Family.” He continued, “Regulatory compliance is a robust and complex management focus, and we are confident that Marlie will help us uphold our obligations, customer experience and business strategies.”

In this role, she is responsible for developing and maintaining the internal compliance program including BSA compliance and AML, ensuring adherence to the institution’s policies and procedures, consumer regulations, and federal and state regulations, communicating with department managers, providing compliance training, supervising assigned personnel and acts as a BSA Officer.

Martines has varied experience, with seven years in the financial industry. Positions include Retail Processing Associate, Retail Client Account Services, Senior Control Administrator, Financial Advisor Services, SOX Governance Testing Manager, Internal Audit, and Talent, Reporting, and Operations Manager, Internal Audit.

She is from Vandling, Pennsylvania, and graduated from West Chester University with a BS in Political Science in 2011 and received her Master of Public Administration the following year.

During her free time, she is a Day of Caring Volunteer, a Hero for St. Jude Children’s Research Hospital and a

Brian M. Sheare Memorial Fund Volunteer.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

Robert Hughes Joins HNB as Chief Technology Officer

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, announced Robert Hughes has joined HNB as Chief Technology Officer.

In making the statement, Sheridan noted, “I am very happy to have Rob rejoin our HNB Family.” He continued, “His experience in information technology systems will help us strengthen our commitment to broadening the security and depth of our systems that provide support to our customers.”

In his role as Chief Technology Officer, Hughes provides direct management over the institution’s information systems and technology functions; ensures system security; oversees networks and telecommunications as well as management of the information technology department.

Hughes began his career with HNB in 2016, as a Systems Analyst and was promoted to Assistant Vice President. He gained additional industry insights during a stint at IBM as a Technical Lead prior to his return to the Bank.

In mentioning his role at HNB, Hughes noted, “At this point in my career, it has made me appreciative of the people that work in the HNB family.”

Hughes is a graduate of Scranton Preparatory High School and received a bachelor’s in business administration from La Salle University in 1999. Certifications include MCSA, MCSE, A+ and Net+.

In his spare time, he is a coach in the Abington Youth Basketball League, Abington Little League, and Abington Youth Soccer.

Outside of the Bank, Hughes enjoys golfing, spending time with his children and traveling to new places.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

26 Employees Recognized for Dedicated Years of Service at HNB

Honesdale, PA – The Honesdale National Bank has had the great fortune of having loyal and long-tenured employees to help serve its customers and greater communities. The Bank is pleased to recognize 26 employees who celebrated milestones of service in 2023.

Thomas E. Sheridan Jr., HNB President & CEO, offered, “Our company's enduring success is a testament to the dedication and unwavering commitment of our longstanding employees, who have been the driving force behind our achievements for many years.” He continues, “Their dedication and expertise continue to lead our company's success and growth each and every day.”

5 Years of Service

Joseph Sweeney, Senior Credit Analyst, Corporate Center; Emily A. Zielinski, Mortgage Loan Processor, HNB Mortgage Center; Catherine Ferraro, VP, Commercial Loan Officer, Eynon Office; Ralph Scartelli, VP, Residential Mortgage Sales Manager, Lake Wallenpaupack Office; Kristain Kochanski, Receptionist, HNB Mortgage Center; Linda Short, PT Teller/CSR Float, Montdale Office; and Marissa Smith, Teller/CSR, Route 6 Plaza Office.

10 Years of Service

Lisa Valentine, AVP, Branch Manager, Montdale Office; Jamie Shnipes, Branch Manager, Eynon Office; Nicholas J. D'Alberto, AVP, Branch Manager, Main Street Office; Charles Curtin, VP, Trust Officer, Corporate Center; William Carmody, Financial Consultant, Corporate Center; and Annie Grado, PT Clerk, HNB Mortgage Center.

15 Years of Service

Christopher Cook, VP, Commercial Loan Officer, Corporate Center; Melissa Rushworth, AVP, Loan Officer, Forest City Office; Maggie Klim, Receptionist, Corporate Center; Raymond Ceccotti, SVP, Business Development & Relationship Manager, Corporate Center; Jeanne Frank, Trust Clerk; Corporate Center; Neil Neumann, PC Support Specialist, Corporate Center; Theresa A. Halliday, Assistant Branch Manager, Main Street Office; and John Conte, AVP, Loan Officer, Main Street Office.

20 Years of Service

Kim Canfield, Head Teller, Montdale Office; Deborah Miller, BSA Assistant, Corporate Center; and Ronald Sebastianelli, SVP, Chief Lending Officer, Corporate Center.

25 Years of Service

Cherese Golya, Loan Servicing Clerk, HNB Mortgage Center.

30 Years of Service

Cindy Motichka, VP, Loan Servicing Manager, HNB Mortgage Center.

HNB extends its appreciation to all its employees for their dedication to supporting its customers and local community!

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit hnbbank.bank.

Photo Caption

5 Years of Service

(Standing Left to Right): Ralph Scartelli, VP, Residential Mortgage Sales Manager, Lake Wallenpaupack Office; Catherine Ferraro, VP, Commercial Loan Officer, Eynon Office; Joseph Sweeney, Senior Credit Analyst, Corporate Center; (Seated Left to Right): Emily A. Zielinski, Mortgage Loan Processor, HNB Mortgage Center; Marissa Smith, Teller/CSR, Route 6 Plaza Office.

10 Years of Service

(Standing Left to Right): Charles Curtin, VP, Trust Officer, Corporate Center; Nicholas J. D'Alberto, AVP, Branch Manager, Main Street Office; William Carmody, Financial Consultant, Corporate Center; (Seated Left to Right): Jamie Shnipes, Branch Manager, Eynon Office; Lisa Valentine, AVP, Branch Manager, Montdale Office

15 Years of Service

(Standing Left to Right): Neil Neumann, PC Support Specialist, Corporate Center; John Conte, AVP, Loan Officer, Main Street Office; Melissa Rushworth, AVP, Loan Officer, Forest City Office; Raymond Ceccotti, SVP, Business Development & Relationship Manager, Corporate Center; Maggie Klim, Receptionist, Corporate Center; (Seated Left to Right): Christopher Cook, VP, Commercial Loan Officer, Corporate Center; Theresa A. Halliday, Assistant Branch Manager, Main Street Office.

20 Years of Service

(Left to Right): Deborah Miller, BSA Assistant, Corporate Center; Ronald Sebastianelli, SVP, Chief Lending Officer, Corporate Center; and Kim Canfield, Head Teller, Montdale Office.

30 Years of Service

(Left to Right): Cindy Motichka, VP, Loan Servicing Manager, HNB Mortgage Center.

Skylar Groover Promoted to Branch Manager at HNB

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank has announced Skylar Groover has been promoted to Branch Manager of HNB’s Hallstead Office.

In making the announcement Sheridan stated, “Skylar plays a vital role in our Susquehanna County community.” He continued, “She remains eager to learn and adapt to new challenges while remaining focused on providing incredible customer service to all.”

As Branch Manager, Groover will be responsible for managing the daily operations of the Hallstead Office as well as connecting with customers to understand how to better serve the community.

She is a graduate of Montrose Area High School and is working toward a degree in Marine Science with a focus in Geology.

With just over two years of experience, Groover began her career in the financial industry in 2020 as a part-time teller at HNB. She went on to become a full-time teller, later accepting a position as CSR. She was promoted to Branch Supervisor in 2022.

In commenting on her new role at the bank, Groover noted, “HNB has allowed me room to grow in my career while giving me the tools and leadership to be successful in all areas of banking.” She noted, “Every day I am able to help a customer, I leave work knowing I have made a difference and that is why I love going to work.”

Outside of the bank, she is a Certified Master Scuba Diver, a member of the New Milford Rotary, loves golfing, and spending time with her family.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna, and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

Jamie Shnipes Promoted to Branch Manager at HNB

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank has announced Jamie Shnipes has been promoted to Branch Manager of HNB’s Eynon Office.

In making the announcement, Sheridan stated, “Jamie began her banking career at HNB with the opening of our Eynon Office.” He continued, “We are proud to see her grow with us here at the bank, as she has shown great commitment to those in our local community.”

As Branch Manager, Shnipes will be responsible for generating business within the Eynon Office and managing daily workload to ensure customer expectations are met. She will lead the supervision of frontline personnel, while ensuring the office is compliant with audits and account management.

Shnipes began her career in the financial industry in 2013 as a Part-time Teller/CSR at HNB. In 2018 she accepted a full-time position at the bank. She will continue growing her career as Branch Manager of our Eynon Office.

In commenting on her time at the bank, Shnipes noted, “Working at HNB has given me the opportunity to grow in the banking industry.” She continued, “When I became a teller/CSR at HNB, I fell in love with my job, and continued to meet great people in my community and at work.”

Shnipes resides in Eynon, Pa. and is a graduate of Valley View High School. Outside of the bank, she enjoys being with family, either hanging out by the pool or spending time at their camper.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna, and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

Kate Bryant Promoted to Executive Vice President, Chief Financial Officer

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, has announced Kate Bryant has been promoted to Executive Vice President, Chief Financial Officer (CFO).

In making the announcement, Sheridan stated, “Kate continues to excel in her role and elevate the bank’s executive leadership team.” He continued, “Her contributions to maintaining HNB’s strength and stability and upholding shareholder value are the characteristics that will continue to drive us forward.”

Bryant has served as the Bank’s CFO since 2016, through which she is responsible for managing the financial planning of the bank and helps direct its overall executive strategy across all departments. She had been previously promoted to Senior Vice President, CFO in 2020.

Bryant began her career in the financial industry in 1999, starting in the banking industry in 2003. She joined HNB in 2004 in the Accounting Department and has helped shepherd the development of accounting and Bank Security Act (BSA) functions.

In commenting on her time at the bank, Bryant noted, “HNB provides me with ongoing opportunities which support my overall professional growth and allows me to be an active participant in my community, for which I am very grateful.”

Bryant resides in Honesdale, Pa. and is a graduate of Honesdale High School. She obtained her Bachelor of Science in Finance and Minor in Economics from Indiana University of Pennsylvania. She later received her Master of Business Administration from Villanova University.

Outside of the bank, she enjoys spending time with friends and family.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

Melissa Rushworth Promoted to Assistant Vice President, Loan Officer

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, announced Melissa Rushworth has been promoted to Assistant Vice President, Loan Officer.

In making the announcement, Sheridan stated, “I am pleased to promote Melissa to this new role as she grows personally and professionally here at HNB.” He continued, “With her dedication and longstanding record in the Forest City community, it is evident that her experience will lead to success in her new role.”

As AVP, Loan Officer, Rushworth will assist customers with direct and indirect consumer loans, mortgages, and home equity loans.

Rushworth started her banking career in 1998. She joined HNB in 2008 and has held various positions throughout her career including: Sales Associate, Teller, CSR, Branch Supervisor, Head Teller, Assistant Branch Manager, Branch Manager, Human Resource Assistant and now Loan Officer.

In commenting on her new position at HNB, Rushworth noted, “HNB has given me the opportunity to grow both personally and professionally. It really is like a second family.” She continued, “With the banking industry ever changing it's comforting to know that we are committed to doing what's best for our employees, customers and the communities we serve.”

Rushworth is from Mayfield, graduated from Lakeland Jr. Sr. High School and has completed various continued learning opportunities through coursework through Pennsylvania Bankers Association, BAI, ICBA, and leadership seminars.

Outside of the bank, she is part of the Forest City Lions Club and loves spending time with family, going on vacations, camping, and gardening. She is an active supporter of all her children's school and sporting events.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

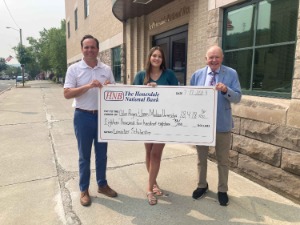

Lemnitzer Memorial Fund Supports 2023 Graduates

Honesdale, PA – The Ernest and Margaret Lemnitzer Memorial Fund, administered by the Trust Department at The Honesdale National Bank and local Honesdale businessman, Paul Meagher, continued its support of those pursuing higher education with the awarding of scholarships to 2023 graduates with a total distribution of $18,418.86.

The Ernest and Margaret Lemnitzer Memorial Fund was created by these prominent Honesdale residents to support designated charitable organizations within Wayne County, as well as, to provide scholarships to deserving graduates of Wayne Highlands High School. Ernest was the brother of the former Chairman of the Joint Chiefs of Staff and Honesdale resident, Lyman Lemnitzer.

Chloe Rogers, the 2023 recipient of the “Ernest and Margaret Lemnitzer Nursing Scholarship” is scheduled to attend James Madison University to study nursing in the fall. She is a 2023 graduate of Wayne Highlands High School. The selection of the nursing scholarship recipient is made by the Women’s Auxiliary of the Wayne Memorial Hospital and is based on scholastic achievement. This scholarship totals $18,418.86.

The Honesdale National Bank Trust Department has managed the investments of the Memorial Fund since its inception in 1991. Through prudent investment of the trust assets, grants in excess of $2.7 Million have been paid to qualifying recipients to date. A total of $432,070.80 has been distributed through the Ernest and Margaret Lemnitzer Scholarships alone. For more information about the HNB Financial Group, please call 570-253-3355 or visit the HNB Corporate Center in Honesdale.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on Honesdale National Bank’s products and services, visit hnbbank.bank.

Photo Caption: Pictured (L to R) are Charles Curtin, JD, LLM and HNB VP, Trust Officer; Chloe Rogers, scholarship recipient; and Paul Meagher, co-trustee.

Destiny Megivern Named Investment Assistant for HNBFS

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, has announced Destiny Megivern has named Investment Assistant with HNB Financial Services.

In making the announcement Sheridan stated, “Destiny is a very well-rounded team member here at HNB. She continues to adapt through new roles and grows by providing our customers and fellow employees with the HNB & me experience.”

As Investment Assistant, Megivern will be responsible for assisting the HNB Financial Services department in the daily workflow to maximize the sales efforts and minimize the time spent on operational tasks. This includes scheduling appointments, completing and submitting forms, and answering phone calls.

She is a graduate of Forest City Regional School District and resides in Pleasant Mount, PA. Megivern was a manager at Weis in Honesdale before starting at the bank in 2018 as a Teller. She moved away for a short period and was a Universal Banker for a bank in Colorado. When she returned to Pennsylvania, she was rehired in Loan Operations at HNB, and then served as a Teller/ CSR before accepting her current role as Investment Assistant.

In commenting on her new role at the bank, Megivern noted, “I love working at HNB, that is why as soon as I knew I was moving back to PA, I called to see if I could be rehired.” She continued, “HNB is truly one big family, and it makes you look forward to coming to work every day.”

Outside of the bank, she loves to read, bake, and spend time with friends and family.

HNB Financial Services Registered Address and Phone: 724 Main Street, Honesdale, PA 18431; 570-253-3355Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFGIS Insurance Agency), member FINRA(Opens in a new Window)/SIPC(Opens in a new Window). Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Investments are: *Not FDIC/NCUSIF insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna, and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank. Photo Caption: Destiny Megivern

Tom Zurla Promoted to VP, Training & Development Officer

Honesdale, PA – Thomas E. Sheridan Jr., President, and CEO of The Honesdale National Bank, announced Thomas Zurla has been promoted to Vice President, Training & Development Officer at HNB.

In making the announcement, Sheridan stated, “We are excited to give Tom the lead in this new role.” He continued, “He consistently shows enthusiasm and strategy in considering our opportunities to grow our team and support customer service levels and we can’t wait to have them translate into an ever-growing customer experience.”

As Vice President, Training & Development Officer, Zurla will be working with new and existing team members to increase their skill set and help provide a higher and consistent level of customer service. He will work on enhancing and implementing more streamlined practices for both front and back-office employees to elevate the customer experience.

Zurla began his career in banking at another financial institution as a Teller/CSR in 1997 and has since held positions including Relationship Manager, Assistant Branch Manager/Branch Manager Retail Banking Training Coordinator, and AVP, Community Office Manager at. He joined HNB as AVP, Area Manager in 2022 based in the Bank’s Clarks Summit Office.

In commenting on his new position at HNB, Zurla noted, “HNB has brought me back to my roots of what it means to be a part of a community bank and be part of a family of bankers. We take pride in our culture and history and do our best every single day to give our customers the "HNB & Me" experience they have long associated us with.”

Zurla is a graduate Coughlin High School, Graduate of Luzerne County Community College and has obtained a degree in Business Management – Technology and holds and NMLS Certification.

Outside of the bank, he is a Board Member of the Rotary of the Abington’s, Treasurer and Vestry Member of St. Luke’s Episcopal Church, Alzheimer’s Association volunteer, and an organist/Soloist at Various Churches throughout NEPA.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. For more information on HNB’s products and services, visit www.hnbbank.bank.

James Marsh Joins HNB as Branch Manager

Honesdale, PA – Thomas E. Sheridan, President, & CEO of The Honesdale National Bank, announced James Marsh has joined HNB as a Branch Manager of the HNB Forest City Office.

In this role, he is responsible for oversight of the operations of staff and customer service in our Forest City office. He will provide opportunities for staff to grow by coaching and leading by example. Marsh will retain any relationships this bank has with all current customers and expand or create relationships with new customers.

President & CEO, Thomas E. Sheridan Jr., noted, “We are excited to have James join our team in Forest City, and his enthusiasm mirrors HNB’s interests in supporting our communities. He said, “His overarching career experience will allow ease of development internally while ensuring the provision of great costumer service for our current and future customers of HNB.”

Marsh has eight years in the financial industry, previously working at another area financial institution as a Teller and Customer Service Representative. He also has seven years of experience teaching at Stroudsburg Area School District and Commonwealth Charter Academy.

He grew up in Clarks Summit and currently resides in Lake Ariel. He is a graduate of Abington Heights High School, attended Keystone College for a bachelor’s degree in education with a minor in psychology, and currently attending The University of Phoenix for a master’s degree.

In mentioning his role at HNB, Marsh noted, “Working with HNB has given me ample opportunity to grow professionally and learn not only about this company, but about myself. Each employee has been very gracious, kind, and very helpful with my entering the company.” He continued, “This point in my career has been very rewarding to say the least. I hope to learn and grow with this company for many years to come.”

Outside of work, he likes to sing, cook, play with his 3 dogs, and be outside whenever possible.

HONAT Declares Quarterly Cash Dividend

HONAT DECLARES QUARTERLY CASH DIVIDEND

April 28, 2023 (Honesdale, PA) – On April 25, 2023, the Board of Directors of HONAT Bancorp, Inc., whose wholly owned subsidiary is The Honesdale National Bank, declared a quarterly cash dividend of $.65 per share to shareholders of record on May 15, 2023, payable on May 31, 2023.

The dividend payment is a 4.8% increase over the dividend paid during the 2nd quarter 2022 and reflects the Bank’s ongoing commitment to providing shareholder value by increasing the dividend year over year.

Honat Bancorp, Inc. (HONT: US OTC) is the parent company of its wholly owned subsidiary, The Honesdale National Bank, headquartered in Honesdale, Pennsylvania. The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest, independent, community bank headquartered in Northeastern Pennsylvania, with twelve full-service offices across Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. Financial Services and Trust solutions for their customers are also serviced through their HNB Financial Group headquartered in Honesdale and the HNB Mortgage Center headquartered in Wilkes-Barre, Pennsylvania. To learn more visit hnbbank.bank, or call 570-253-3355.

This Press Release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements regarding future financial conditions, results of operations and/or the Bank's business operations are not guaranteed and include risks, uncertainties and assumptions. Actual results and trends may differ materially from those set forth in such statements due to various factors including operating, legal and regulatory risks; economic, interest rate and competitive environments; and other risks and uncertainties.

The Honesdale National Bank Makes Donation to Susquehanna School District

Honesdale, PA – The Honesdale National Bank has recently made a $5,000 contribution to the Susquehanna Community School District via Commonwealth Charitable Management, Inc. through the Educational Improvement Tax Credit Program. The funds will go towards financial education programs in the school district.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “We are happy to support this school as they enhance their educational curriculum.” He continued, “The best way to get children and young adults prepared for the next step in life, is providing access to critical financial lessons and resources.”

The mission of the Susquehanna Community School District is to nurture an educational environment that will develop life-long learners who will be successful participants in an ever-changing world. Commonwealth Charitable Management, Inc. has been administering EITC since 2003. They have over a decade of experience and have provided millions of dollars in funding to support thousands of students.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna, and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. HNB is a Member FDIC and Equal Housing Lender with NMLS ID # 446237.

Pictured (L to R): Mr. Robert Goodrich, Michelle Kowalewski, Commercial Loan Officer, HNB; Skylar Groover, Hallstead Branch Supervisor, HNB along with students of the Susquehanna Community School District.

The Honesdale National Bank Makes Donation to Susquehanna County Interfaith

Honesdale, PA – The Honesdale National Bank has recently made a $3,000 contribution to The Susquehanna County Interfaith through the Educational Improvement Tax Credit Program. The funds will go specifically to the organization’s Parent Pathways Program.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “Life can change in the most unexpected ways and having organizations like this is something that binds the community together.” He continued, “We are excited to make this contribution in efforts to assist the communities we serve.”Susquehanna County Interfaith provides access to emergency assistance, advocacy programs, and resources for personal development/life change. They offer educational pathways for personal development and long-term independence.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. HNB is a Member FDIC and Equal Housing Lender with NMLS ID # 446237.

Pictured (L to R): Karlee Shibley, Lead Case Manager, Susquehanna County Interfaith; Cindy Beeman, Executive Director, Susquehanna County Interfaith; Michelle Kowalewski, Commercial Loan Officer, HNB; Skylar Groover, Hallstead Branch Supervisor, HNB.

The Honesdale National Bank Foundation Donates to Keystone Mission

Scranton/Wilkes-Barre, PA – The Honesdale National Bank Foundation presented Keystone Mission with a $2,500 check to support the hiring of an aftercare life coach for the 2023 year.

Keystone Mission desires to be the Catalyst for the Community, to provide help and hope to the homeless, hungry, and hurting people in Northeast PA. Aftercare is critical for homeless prevention. The goal of this program is to allow graduates to stay connected with supportive case management to ensure a full transition into self-sufficiency, avoiding relapse into homelessness.

The life coach will perform follow-up care through home visits, telephone calls, and counseling sessions. They will lend extra support and guidance to our and other community graduates upon successful transition out of homelessness and into the community. At the end of the program, individuals will be able to navigate and network with other community agencies while working through the Genesis Process to gain better life skills such as budgeting and nutrition.

“Keystone Mission is a critical partner in our community as we look to decrease homelessness and increase opportunities for all neighbors in NEPA,” said Elizabeth Nagy, Treasurer of The Honesdale National Bank Foundation. “We are glad to be able to extend our financial support to help graduates of their programs sustain independent living with proper skills and support networks.”

Keystone Mission is pleased to work with organizations in the community, such as the Honesdale National Bank Foundation, to grow its services in the Northeastern Pennsylvania region.

Lisa Valentine Promoted to AVP, Branch Manager of Montdale Office

Honesdale, PA – Thomas E. Sheridan, President and CEO of The Honesdale National Bank, announced Lisa Valentine has been promoted to Assistant Vice President, Branch Manager overseeing the HNB Montdale Office.

In making the statement, Sheridan noted, “Lisa is an experienced and valued member of the HNB team. We are eager to see her grow in her new role. Her vast understanding of our offerings and standards is a valuable resource for providing the best service to our customers”.

In her current role as Branch Manager, she is responsible for managing the daily operations of the HNB Montdale Office, building customer relationships, and capitalizing on opportunities to grow business opportunities.

Valentine has 18 years of experience in the financial industry. She started as a part time teller at HNB, then teller/CSR, was promoted to head teller, then Assistant Branch Manager, to her current role as Branch Manager at the Montdale Office.

In mentioning her role at HNB, Valentine said, “I’m grateful to HNB for giving me the opportunity to advance in my career. I love getting to know customers and helping them with their financial needs.”

She currently lives in Lenox Township on her family farm. She graduated from Forest City Regional School District.

Outside of the bank, her spare time is spent gardening, hiking and exploring the outdoors.

HNB Makes Contribution to Leadership Lackawanna SimSoc Program

Honesdale, PA – The Honesdale National Bank Foundation has recently made a $2,100 contribution to Leadership Lackawanna. The funds will be used to support their SimSoc Program.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “The Foundation is pleased to assist in creating leaders in our community” He then mentioned, “members of our area are supplied with an assortment of skillsets and qualities, and it is important to provide options to drive their opportunity for impact in today’s society.”

SimSoc is a training program that cultivates an unlimited amount of skills such as communication, trust, problem-solving, empathy, decision-making, interpersonal feelings, and much more. This program will be implemented into their Core program to give participants experience and a better understanding of the complexity of our society.

The Honesdale National Bank Foundation was established to further support the Bank’s commitment to contributing to the growth and development of the communities we serve.

Leadership Lackawanna is a 501(c)(3) charitable, nonprofit organization in northeastern Pennsylvania dedicated to community leadership and professional development. Its six programs - Tomorrow’s Leaders Today, Core, Executive, Leadership Collegiate, Leadership Fundamentals, and Welcome Scranton! - enhance the skills, connections, and knowledge of emerging and established leaders, enabling them to better serve in our communities, workplaces, and organizations. All program curriculum follows the format and standards of all other community leadership programs throughout the United States. Since its inception, Leadership Lackawanna has graduated more than 2,400 community leaders.

The Honesdale National Bank Foundation is a 501(c)3 entity established by The Honesdale National Bank to engage in community giving initiatives that foster the area’s growth and resources as it has remained committed to since its founding in 1836. The Foundation’s aims to fulfill that mission through initiatives that support the sustainability and strengthening of resources and programming that make local communities thrive and remain desirable places to live, work, and play. The mission will be upheld through the provision of funding for public charities, institutions, schools and other not-for-profit organizations throughout our local area.

The Honesdale National Bank (HNB), established in 1836, is a subsidiary of Honat Bancorp, Inc. HNB holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna, and Luzerne Counties.

Photo Caption: Nikki Morristell, Leadership Lackawanna, Jill Robinson, Endless Mountains Visitors Bureau, Alissa Weiss, Cash Management Officer at HNB, Andrew Pickett, The Miles Company, Jim Warren, Warren Construction, Gina Suydam, Leadership Wyoming.

Local Banks Remain Pillars of Strength & Stability

The FDIC’s seizure of two larger financial institutions once again shapes the current and future landscape of the financial industry. Fortunately, local businesses and families remain ever supported by the strength and stability of three banks through which this corner of Northeastern Pennsylvania was built.

The stability of a community can often be defined by the strength of the partnerships that comprise it. For Honesdale and the greater Wayne County area, the individual and collective business practices of The Honesdale National Bank, The Dime Bank, and Wayne Bank continue to fasten the region’s seams.

While the institutions are unique, since their foundings they have shared a common goal — supporting the residents and businesses across the widening breadth of the communities they serve. Diversifying their loan concentrations and oftentimes sharing the risk burden in the name of business development has paved a landscape that is symbolic of community banking.

No financial institution is completely immune to the impact of economic, political or industry-driven events. These Banks’ conservative business models have helped decrease exposure and effectively manage the market’s highs and lows. Their healthy capital and investment strategies have shepherded expansion in markets and resources to stabilize external pressures and foster growth opportunities.

Healthy competition and collaboration are what set these community banks apart and continue to provide strong, dynamic financial resources for the local population.

The leadership of Wayne Bank, The Honesdale National Bank, and The Dime Bank continue to monitor the markets closely and are prepared to respond to changes as necessary. The local teams at each of their office locations are also available to support questions regarding FDIC insurance and individual financial needs.

A Message from Our President & CEO

Since 1836, The Honesdale National Bank has engaged in practices that have supported the growth of our communities while ensuring the safety and soundness of our financial institution and the opportunity for our customers.

Since 1836, The Honesdale National Bank has engaged in practices that have supported the growth of our communities while ensuring the safety and soundness of our financial institution and the opportunity for our customers.

As a community bank, we are mindful of the financial interests that not only shape our local community but the global economic community. We have built and remain committed to strong business practices that are diversified and conservatively manage our risk exposure. As a result, we remain strong and well-capitalized to support turbulence that has presented itself in so many shapes and forms over the course of our more than 186-year tenure.

We are proud to be a long-standing Bauer 5-Star Financial Institution and remain confident in our abilities to continue to support the needs of our customers and local area. As a hometown, local bank, our hands-on team knows you and will continue to guide you and connect you with the resources to support a strong financial future for you, our local businesses and communities.

As always, our team remains ready and accessible to support any questions or concerns you may have regarding FDIC Insurance or your other financial needs. On behalf of The Honesdale National Bank, we appreciate your support and look forward to continuing to support your goals.

FDIC Insurance by Charlie Curtin, JD, LLM, CTFA, VP, Trust Officer

I am a child of the late 1970s and early 1980s, so I did not grow up with the hard financial lessons of my Depression-era grandparents. It took me a long time to understand why my grandmother hid $100 bills in her cookie jar, refrigerator, and literally under her mattress. For me, going to her house was a treasure hunt…I felt like Indiana Jones. I would always be on the lookout for a stray bill. My grandparents were from a different era. They experienced tremendous economic adversity during their lives. To them, cash under the mattress was a better alternative than using a bank.

I am a child of the late 1970s and early 1980s, so I did not grow up with the hard financial lessons of my Depression-era grandparents. It took me a long time to understand why my grandmother hid $100 bills in her cookie jar, refrigerator, and literally under her mattress. For me, going to her house was a treasure hunt…I felt like Indiana Jones. I would always be on the lookout for a stray bill. My grandparents were from a different era. They experienced tremendous economic adversity during their lives. To them, cash under the mattress was a better alternative than using a bank.

The Federal Deposit Insurance Company (FDIC), formed via the 1933 Banking Act, was created specifically to assure bank depositors of the soundness of the nation’s banking system. Its purpose was to inspire consumers’ confidence in the banking system by providing deposit insurance to banks and to prevent people like my grandmother from hoarding their cash. Bank depositors’ money is insured and backed by the Federal Government. In fact, since the founding of the FDIC all those years ago, no depositor whose account was FDIC insured has lost a penny due to a bank failure.

The majority of banks in the United States are members of the FDIC, including all banks with the term “national” in their name. A complete list of FDIC participants is available at the FDIC website.The FDIC only provides insurance to depositors of banks. It does not provide insurance for stocks, bonds, mutual funds, or other financial/investment services that the bank may offer.

Most bank customers know that their deposits are insured up to $250,000. Savings, checking, and other deposit accounts are included in ascertaining the $250,000 threshold. For example, a customer with a $100,000 checking and a $150,000 savings account in their own name would be fully insured, but if the customer’s savings and checking accounts combined totaled $300,000, then only the first $250,000 would be insured. The other $50,000 could be lost in the event the bank went belly up.

The $250,000 number is stuck in many people’s mind as a bright line, but I would like to point out that there are techniques available to increase the amount of insurance your deposits have at one bank. The FDIC provides $250,000 in coverage to four different categories of accounts. This means you are afforded $250,000 of insurance in four different buckets, which are:

- Accounts held in your name alone.

- Accounts you hold in a joint name with another person.

- IRA or other qualified accounts.

- Accounts that you open in trust for (ITF) another person.

You can theoretically have up to $1,000,000 of insured deposits at one institution if you are single and $2,000,000 for a married couple. So, if you have an IRA, a checking, and an ITF account each with $100,000, the full $300,000 would be insured. To be safe and confirm that your accounts are insured, you are urged to visit the FDIC’s Electronic Deposit Insurance Estimator, a site where the FDIC itself will calculate the amount of insurance coverage you currently possess.

$250,000 is a lot of money to have on deposit at one single bank. As a banker, I love deposits, but that much liquid cash might not be the best way to maximize your money. If you desire FDIC insurance with a little bit of investment return, a Certificate of Deposit (CD) could be right for you. CDs offer a higher rate of interest than a regular savings account as long as you keep and do not touch the CD principal, with the added bonus of being FDIC insured. When purchasing a CD with insurance in mind, there are a few things to note. First, not all banks are FDIC insured, so double check the FDIC’s website before purchasing. Second, if the CD is linked to the market or offers a variable rate of interest, it is likely not an FDIC insured product but an uninsured investment. Third and finally, if the CD combined with your other bank deposits pushes you over the $250,000 threshold, then you may have to look for alternative titling methods like the ones described above to ensure adequate insurance.

With a little creativity and planning, you can make sure your deposits are FDIC insured. It is true that we are currently in a low interest rate environment, but with the FDIC, a bank deposit is better than stashing your cash in empty coffee cans. If you need help navigating the FDIC or have other questions regarding your finances, stop by an HNB office and ask to speak to one of our wealth management representatives.Kathy Enslin Promoted to Vice President, Chief Operations Officer

Honesdale, PA – Thomas E. Sheridan Jr., President and CEO of The Honesdale National Bank, announced the promotion of Kathy Enslin to Vice President, Chief Operations Officer.

Honesdale, PA – Thomas E. Sheridan Jr., President and CEO of The Honesdale National Bank, announced the promotion of Kathy Enslin to Vice President, Chief Operations Officer.

“With this promotion, we are very pleased to showcase Kathy’s technical, operational and innovative leadership,” said Sheridan. “Kathy’s appointment as COO is a strategic step for our organization and we know that her experience and skillset will continue to advance the Bank’s opportunities for growth as well as that for our customers.”

“I am grateful for the opportunity to contribute to The Honesdale National Bank’s continued growth. I am looking forward to embarking on this new chapter in my career and new chapter for HNB.”

Enslin joined The Honesdale National Bank in 1999 as an Assistant Vice President, Bookkeeping after spending 24 years with another area financial institution. In that role, she was an integral player in the oversight and development of many procedures and advancements that supported the Bank’s core account management and transaction workflows. Enslin previously held the position of VP, Deposit Operations Officer for several years at HNB prior to her promotion to Vice President, Compliance Officer in 2015.

Enslin started her career in banking shortly after graduating from Western Wayne High School and has furthered her education through the American Institute of Banking (AIB).

HNB Foundation Makes Contribution to Honesdale High FBLA

Honesdale, PA – The Honesdale National Bank Foundation has recently made a $3,500 contribution to Honesdale High School. The funds will be used to support the costs associated with the students' participation in the Future Business Leaders of America, Inc. (FBLA) Conference to be held in Hershey, Pa.

Honesdale, PA – The Honesdale National Bank Foundation has recently made a $3,500 contribution to Honesdale High School. The funds will be used to support the costs associated with the students' participation in the Future Business Leaders of America, Inc. (FBLA) Conference to be held in Hershey, Pa.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “We are pleased to support the hard-working FBLA students at Honesdale High School.” He continued, “Championing opportunities to develop career skills among the next generation will not only enable their paths to success but continue to benefit our local business community.”

The FBLA is the largest business Career and Technical Student Organization in the world. Each year, FBLA helps over 230,000 members prepare for careers in business. The FBLA inspires and prepares students to become community-minded business leaders in a global society through relevant career preparation and leadership experiences.

The Honesdale National Bank Foundation was established to further support the Bank’s commitment to contributing to the growth and development of the communities we serve. The Foundation’s mission is to support the sustainability and strengthening of resources and programming that make our communities thrive and remain desirable places to live, work and play. The mission will be upheld through the provision of funding for public charities, institutions, schools, and other not-for-profit organizations throughout our area. Through a focus on health and human services, education, culture and community enhancements, the Foundation intends to exemplify corporate citizenship and continue to create opportunities for all that benefit from our region’s offerings. The Honesdale National Bank Foundation is a registered 501(c)3

HNB Foundation Makes Contribution to Wanye County Arts Alliance

Honesdale, PA – The Honesdale National Bank Foundation has recently made a $10,000 contribution to the Wayne County Arts Alliance. The funds will go toward the purchase of their new facility in Honesdale.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “We are excited to make this contribution on behalf of the Foundation.” He continued, “The Wayne County Arts Alliance is a fantastic asset to growing individuals in our community, and keeping our neighborhoods filled with creativity.”

The building is located at 959 Main Street in Honesdale. The funding will support capital improvement goals for the building - which includes creating a downstairs gallery, electrical safety repairs, security, internet, bathroom update, and utility repairs required by new borough ordinances.The Wayne County Arts Alliance is a not-for-profit organization entirely governed by volunteer members, a society composed of artists and people interested in the beneficial effects of the arts. We are committed to developing a dynamic, art-friendly atmosphere in the community, one that enhances and enriches the lives of its citizens.

The Honesdale National Bank Foundation was established to further support the Bank’s commitment to contributing to the growth and development of the communities we serve. The Foundation’s mission is to support the sustainability and strengthening of resources and programming that make our communities thrive and remain desirable places to live, work and play. The mission will be upheld through the provision of funding for public charities, institutions, schools, and other not-for-profit organizations throughout our area. Through a focus on health and human services, education, culture and community enhancements, the Foundation intends to exemplify corporate citizenship and continue to create opportunities for all that benefit from our region’s offerings. The Honesdale National Bank Foundation is a registered 501(c)3

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. HNB is a Member FDIC and Equal Housing Lender with NMLS ID # 446237.

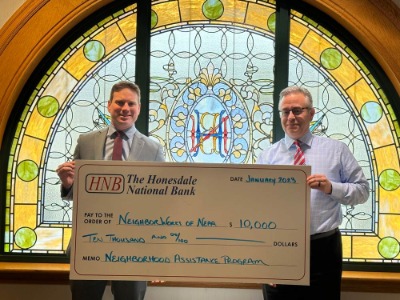

HNB Makes Donation to NeighborWorks of Northeastern Pennsylvania

Honesdale, PA – The Honesdale National Bank has recently made a $10,000 contribution to NeighborWorks of Northeastern Pennsylvania through the PA Department of Community & Economic Development’s (DCED) Neighborhood Assistance Program. The funds will go specifically to the organization’s Special Program Priorities (SPP) project.

Honesdale, PA – The Honesdale National Bank has recently made a $10,000 contribution to NeighborWorks of Northeastern Pennsylvania through the PA Department of Community & Economic Development’s (DCED) Neighborhood Assistance Program. The funds will go specifically to the organization’s Special Program Priorities (SPP) project.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “Revitalization of our local neighborhoods is one of our true passions here at HNB.” He continued, “NeighborWorks shares the same goal in assisting the lives of those in our local communities, and we are glad to support their cause with this contribution.” NeighborWorks Northeastern Pennsylvania is a 501(c)(3) nonprofit community development organization that has, for more than 40 years, helped to revitalize neighborhoods and improve lives throughout the region by addressing the housing needs in our community. Our vision for strong, healthy neighborhoods is built on resident empowerment, neighborhood revitalization, sustainable homeownership, and public-private partnerships.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. HNB is a Member FDIC and Equal Housing Lender with NMLS ID # 446237.

Pictured (L to R): Jesse Ergott, President & CEO and Ray Ceccotti, SVP, Business Development & Relationship Manager at HNB

HNB Administers Stegner Foundation Honoring Local Family Legacy

February 13, 2023 Honesdale, PA – As announced by the trustee, The Honesdale National Bank, the greater Wayne County community will continue to experience the generosity of the beloved Honesdale family for years to come with the launch of and first disbursements of The Robert E. and Leila Stegner Family Foundation.

Honesdale, PA – As announced by the trustee, The Honesdale National Bank, the greater Wayne County community will continue to experience the generosity of the beloved Honesdale family for years to come with the launch of and first disbursements of The Robert E. and Leila Stegner Family Foundation.

The Robert E. and Leila Stegner Family Foundation was created by siblings Dr. Robert, Joan and Janet Stegner of Honesdale, Pennsylvania, “in thanksgiving to the people of Wayne County and elsewhere for the support given to J.H. Stegner Grocery Store and Bakery, Robert J. Stegner, DDS, Joan M. Stegner and Janet T. Stegner, private music teachers.” The Foundation was established after the passing of the last surviving sibling, Joan Stegner, on October 7, 2022. The Honesdale National Bank has served as trustee since May 25, 2011.

The Stegner siblings selected 13 organizations to receive annual donations from their Foundation based upon a set percentage of the minimum distribution requirement for private foundations code established by the Internal Revenue Service (IRS). The recipient organizations are Bethany Cemetery; Honesdale Fire Department Hose Company No. 1, Alert Hook & Ladder Co. No. 2, Protection Engine No. 3, and Texas No. 4; Victims Intervention Program; Wayne County Food Pantry; Wayne County Children and Youth; Red Cross, Wayne County chapter; Salvation Army; the Eastman School of Music at the University of Rochester; Honesdale Ministerium; and the Wayne Memorial Health Foundation.

“It is an honor for HNB to assist in sustaining the memory and impact of the Stegner family for the greater Wayne County community,” said VP, Trust Officer Charles Curtin. “This Foundation is the epitome of a local family demonstrating its gratitude for the services that serve as the backbone for our area and ensuring others have access to those services for years to come.”

The Stegner name is iconic in the Honesdale area. Parents Robert Sr., and Leila Stegner owned and operated the J.H. Stegner Grocery Store and Bakery throughout most of the 20th Century. Many fondly remember its vast candy selection. Their children, Dr. Robert and twins Joan and Janet, were prominent citizens in their own right. Numerous young students were taught to love the piano by Joan and Janet in the family’s living room, while Dr. Robert tended to the community’s dental needs. A particular delight was to see Joan and Janet, in matching outfits, riding their tandem two-seat bicycle around town, waiving to all. Although the scene of the three Stegner siblings languidly rocking on their 8th Street porch swing during long summer days is now just a memory, their generosity lives on.

HNB Foundation Supports NeighborWorks Aging in Place

Honesdale, PA – The Honesdale National Bank Foundation has recently made a $12,500 contribution to NeighborWorks of Northeastern Pennsylvania. The funds will go specifically to the organization’s Aging in Place program.

Honesdale, PA – The Honesdale National Bank Foundation has recently made a $12,500 contribution to NeighborWorks of Northeastern Pennsylvania. The funds will go specifically to the organization’s Aging in Place program.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “We are happy to support NeighborWorks and their continuous efforts with their Aging in Place program.” He continued, “Maintaining the safety and livelihood of our senior community members is something we cherish here at HNB, and we hope these programs are available for generations to come.”

The Aging in Place program provides homeowners age 60 and above with services that focus on assisting them to continue living safely and with dignity in their home and community. Through this program, NeighborWorks collaborates with human services organizations to evaluate individual needs and provide small home repairs, critical safety modifications and community services specific to each homeowner’s lifestyle to preserve their home and their independence. Surveys with their clients show they’re mentally and physically healthier, feel safer at home, and engage with their family and friends more.

NeighborWorks Northeastern Pennsylvania is a 501(c)(3) nonprofit community development organization that has, for more than 40 years, helped to revitalize neighborhoods and improve lives throughout the region by addressing the housing needs in our community. Our vision for strong, healthy neighborhoods is built on resident empowerment, neighborhood revitalization, sustainable homeownership, and public-private partnerships.

The Honesdale National Bank Foundation was established to further support the Bank’s commitment to contributing to the growth and development of the communities we serve. The Foundation’s mission is to support the sustainability and strengthening of resources and programming that make our communities thrive and remain desirable places to live, work and play. The mission will be upheld through the provision of funding for public charities, institutions, schools, and other not-for-profit organizations throughout our area. Through a focus on health and human services, education, culture and community enhancements, the Foundation intends to exemplify corporate citizenship and continue to create opportunities for all that benefit from our region’s offerings. The Honesdale National Bank Foundation is a registered 501(c)3.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. HNB is a Member FDIC and Equal Housing Lender with NMLS ID # 446237.

Pictured L to R: Melodie Robinson, Mary Edrusick, Jesse Ergott, President & CEO of NeighborWorks, and Ray Ceccotti, SVP, Business and Relationship Development Manager at HNB.

HNB Supports F.M. Kirby Center for the Performing Arts

Wilkes-Barre, PA – The Honesdale National Bank Foundation presented $2,500 to the F.M. Kirby Center for the Performing Arts. The funds will be used to support their Laux Young People’s Theater Series. The series includes five stage performances throughout the school year for children from surrounding school districts completely free of charge thanks to supporters like The Honesdale National Bank Foundation.

Wilkes-Barre, PA – The Honesdale National Bank Foundation presented $2,500 to the F.M. Kirby Center for the Performing Arts. The funds will be used to support their Laux Young People’s Theater Series. The series includes five stage performances throughout the school year for children from surrounding school districts completely free of charge thanks to supporters like The Honesdale National Bank Foundation.

The performances returned to the stage in January of 2022 after streaming virtual productions during the Covid-19 shutdown. For more information on the Laux Young People’s Theater Series, visit kirbycenter.org. Pictured from left, are Jordan Steiner, F.M. Kirby Center Donor Relations Manager; Karen Decker, HNB AVP, Kingston Branch Manager; and Joell Yarmel, F.M. Kirby Center Executive Director.

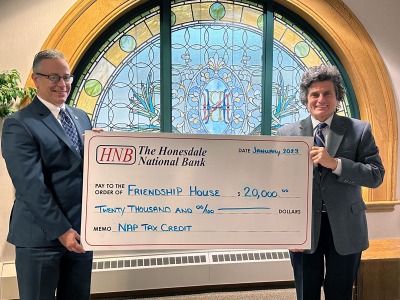

HNB Supports Friendship House

Honesdale, PA – The Honesdale National Bank has recently made a $20,000 contribution to Friendship House through the Neighborhood Assistance Program (NAP) Tax Credit. The funds will help offset the cost of architects and engineers for their building project in Scranton, PA.

HNB President & CEO, Thomas E. Sheridan Jr., stated, “We are glad to make this contribution to support an organization who truly cares about our community members.” He continued, “Friendship House gives many individuals, with physical or mental disabilities, a chance to maximize their well-being with proper support and care.”

The building project in Downtown Scranton is a personal care center. This facility will provide mental health, substance abuse, and primary physical health care.

Friendship House is dedicated to serving families and their children with autism, with emotional and/or behavioral difficulties, and/or who are traumatized by loss, abuse, or neglect. Friendship House is also dedicated to serving adults with mental illness and/or developmental/intellectual disabilities. Their dedication manifests itself by providing individualized services which promote resiliency in children and recovery in adults, and maximize physical, emotional, behavioral, and social well-being of those they serve.

The Honesdale National Bank, established in 1836, holds the distinction of being the area’s oldest independent community bank headquartered in Northeastern PA, with offices in Wayne, Pike, Susquehanna, Lackawanna and Luzerne Counties. The Honesdale National Bank offers personal banking, business banking and wealth solutions. HNB is a Member FDIC and Equal Housing Lender with NMLS ID # 446237.

Photo Caption (from left to right): Ray Ceccotti, SVP, Business and Relationship Development Manager at HNB & Alex J. Hazzouri, President/Chief Executive Officer of Friendship House.

Liz Nagy Featured in January Issue of Happenings Magazine

Check out the January issue of Happenings Magazine, featuring our own Elizabeth Nagy, VP Director of Sales, Marketing and Digital Banking.

Check out the January issue of Happenings Magazine, featuring our own Elizabeth Nagy, VP Director of Sales, Marketing and Digital Banking.

Elizabeth Nagy VP, Director Of Sales, Marketing And Digital Banking, The Honesdale National Bank Balance: The ability to wear a cape and trip on it too

Learning from every experience is something we are reminded of often, and Nagy finds that the proverb helps ensure she doesn’t remain stagnant. “I encourage myself and those around me to be willing and be confident. You never know where an opportunity may take you or what you may learn along the way.”

Nagy didn’t envision a career in banking but is now grateful to be a part of a cutting-edge industry that allows her the opportunity to support her local community.

“When I moved to Pennsylvania, a job in banking was the career opportunity that happened to be at my doorstep. I am grateful I had courage to apply my skills in a new way. Now, I find that I can play an active role in supporting the financial literacy of our communities and the economic opportunities for our friends, neighbors and local businesses. It’s a truly rewarding career path.

Prior to moving to Pennsylvania, Nagy worked at a public relations agency in New York City supporting Fortune 500 consumer and luxury brands. “Life is unpredictable, no matter how much planning is attempted. It’s important to be kind and have grace,” she said. She believes that being genuine and willing to help others will build your personal brand and ensure that your support network is there when you are also in need.

Nagy believes that the strength of NEPA is derived from the very same lessons. “We are very fortunate to live in a region that supports one another and works collectively toward a sustainable future – one family and one business at a time. I am fortunate to work for The Honesdale National Bank, that shares the same sentiment in its approach to its customer service and business practices.”